BTI Stock Analysis

Today, we’re taking an in-depth look at British American Tobacco, ticker symbol BTI. We’ll dive into the financial metrics, assess the company’s growth, and ultimately try to find its fair buy price.

BTI has severely underperformed the S&P 500 and since Jun 2022 until April 2024 BTI’s stock price dropped by more than 40% and although it has slightly recovered, it is still well below it’s historical average mostly due to a gigantic 31.5B$ write-down. BUT, is BTI a Value Play or just a Dead Weight investment? Let’s see.

A. Story/History

British American Tobacco p.l.c. (BAT) is a British multinational company that manufactures and sells cigarettes, tobacco and other nicotine products including electronic cigarettes.

1900s-1940s

British American Tobacco (BAT) was founded in 1902 as a joint venture between the UK’s Imperial Tobacco Company and the American Tobacco Company, with James Buchanan Duke as chairman. The company agreed not to operate in the UK or US, focusing on markets like Canada, China, and South Africa. In China, BAT established a major factory in Shanghai, producing billions of cigarettes until the Japanese occupation in 1941. BAT exited China in 1949 following the establishment of the People’s Republic.

1970s-1990s

In 1976, BAT consolidated its global operations under a new holding company, B.A.T. Industries. The 1990s marked a period of major acquisitions, including BAT’s 1994 purchase of the American Tobacco Company, adding brands like Lucky Strike and Pall Mall. In 1999, BAT merged with Rothmans International, gaining a presence in Burma and attracting criticism due to human rights concerns, which led to its divestment from Burma in 2003.

2000s

In the early 2000s, BAT continued expanding by acquiring Italy’s Ente Tabacchi Italiani (2003), and Turkey’s Tekel (2008), cementing its market position in Southern Europe. In 2004, it merged its U.S. business with R.J. Reynolds to create Reynolds American, where BAT held a significant share. In Indonesia, BAT acquired a full stake in Bentoel by 2010.

2010s

During this period, BAT acquired Colombia’s Protabaco in 2011 and Croatia’s TDR in 2015, furthering its expansion in Latin America and Europe. In 2017, BAT completed a $49.4 billion acquisition of Reynolds American, consolidating its presence in the U.S. market. The same year, BAT bought several Bulgarian cigarette brands, signaling ongoing expansion into Eastern Europe.

2020s

In 2021, BAT diversified into cannabis, acquiring a 20% stake in Canada’s OrganiGram as part of a broader shift toward new product categories. In 2023, BAT sold its Russian operations to a consortium, marking a strategic exit amid geopolitical tensions.

B. Fundamentals/Metrics/Ratios

B.1. Fundamentals

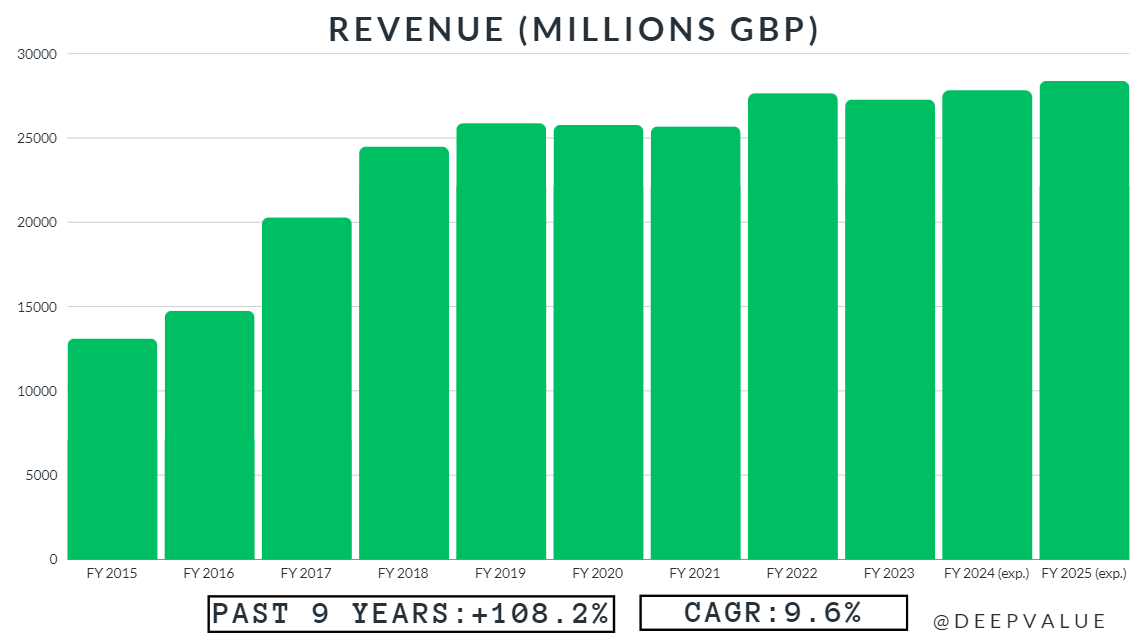

Over the past 9 years their revenue has grown at a CAGR of 9.6% which is mostly due to their acquisition of Reynolds American in 2017. They are only projected to grow at a 2-3% pace for the next 3 years so growth is barely at the inflation breakeven point.

They only started reporting NGP revenue in 2017 and since then it has grown from ~400 M£ to 3.35 B£ (42.7% CAGR). In 2017 they expected 4-5 Billion in Revenue in 2024 so they are definitely on target (this is pretty important since it shows management is capable of keeping their word and giving accurate predictions). They expect NGP products to make up 50% of revenue by 2035. From what we can see their revenue from Old categories was the same in 2023 as in 2018 and it’s hard to say what will happen exactly but the cigarettes market (Sales Volume not Unit Volume) is declining in developed nations and this trend may pick up in other countries but for now their revenue from this category is staying at constant levels.

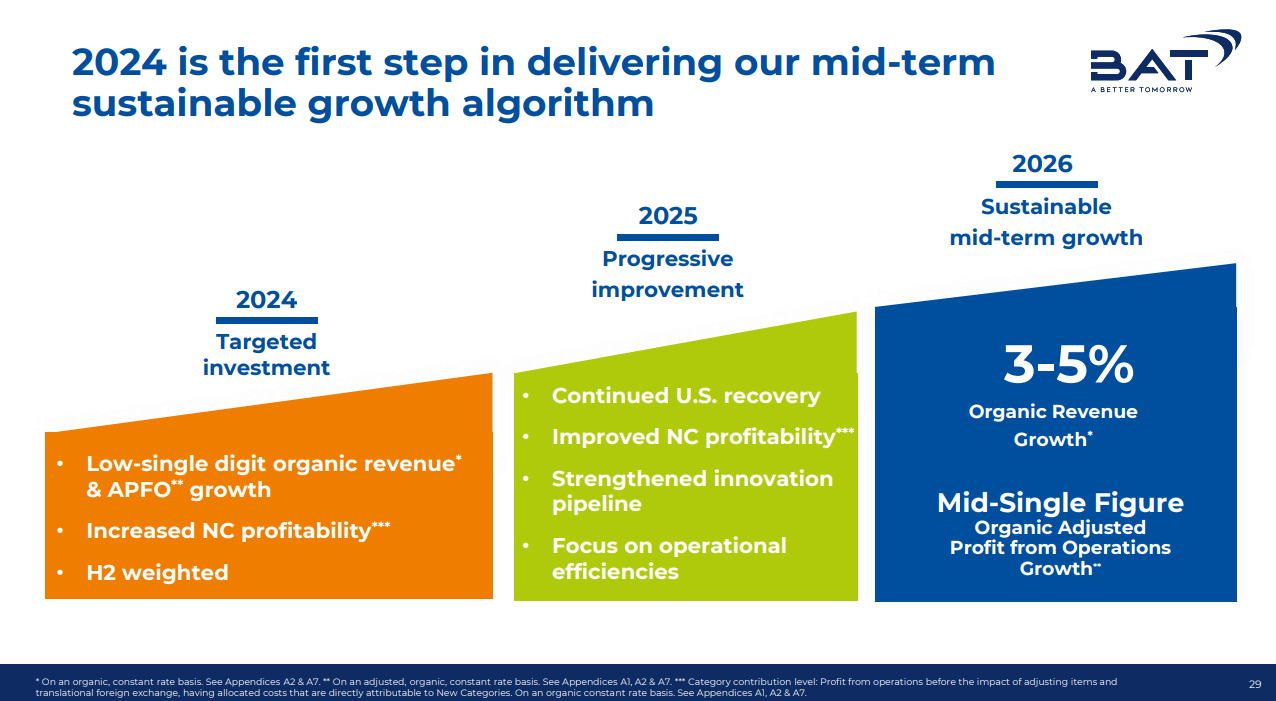

Their FY24 Guidance suggests low single digit group revenue and double digit New Category revenue so this shows that NGP is the main revenue growth driver and as this growth continues, it will slowly become a bigger and bigger part of their business which is something they expect given that they estimate NGP will be 50% of their revenue by 2035.

They project an increase of organic revenue growth to 3-5% in 2026, but it remains to be seen if they can continue to increase their NGP segment revenue at an accelerated pace.

Their Gross Margin has increased by 614 basis points (from 76.85% to 82.99%) which is a lot. Now, their gross margins might start decreasing as NGP becomes a bigger % of their revenue since they have only recently turned profitable on this category so that means they have a much lower gross margin on it, although they are improving margins very fast and NGP is already >10% of revenue and there is basically 0 effect on gross margin so a Gross Margin reduction may not happen, but it is still a notable risk. (It’s hard to know exactly what difference there is in margin between selling a cigarette and a vape)

I found a slide in the FY2023 presentation that shows a 55.9% gross margin, but as you can see it says in the Top 10 Markets so we can’t really say with 100% certainty what their NGP/New Category Gross Margin is if we include all of their markets.

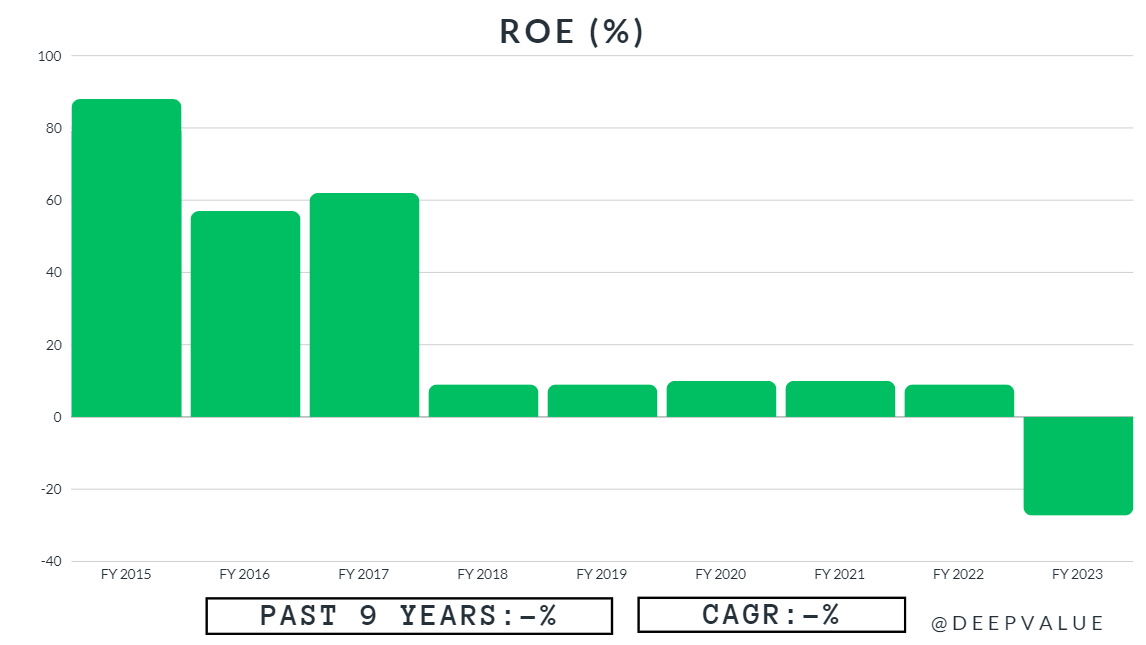

The 2023 loss is due to a write-down of 31.5 B$ on its acquired U.S. combustibles. U.S. brands it holds include Camel and Newport. Their 6.5% CAGR which is expected to hold at least until FY 2025 is respectable and it shows that they have been increasing their NI margin over the past decade. Their FWD (didn’t use 2023 because of write-down) GAAP P/E is 8.46 with an Earnings yield of 12.81%. The average P/E for the Tobacco industry is 14.11.

The Cash Flow From Operations has grown at an almost 11% CAGR over the past 9 years which is very good and most of the growth was caused by Reynolds American. Their P/CFFO is 5.94 and CFFO yield is 16.84%.

Their CapEx is pretty low and has actually decreased since 2015 which shows that the NGP segment is a low CapEx business that only required higher CapEx expenses for a few years (2016-2019) and now it’s returned to lower levels.

Their CFFO margin (CFFO/Revenue) is 40.11% and their CapEx margin (CapEx/Revenue) is 1.8%.

Their CFFO margin was 36.02% in 2015 and their CapEx margin was 3.7% .

CFFO margin improved by 409 basis points and CapEx margin halved.

Their CapEx guidance for 2024 is 600M£. (In the LT Debt section I present a page from their HY2024 that also shows their capex guidance)

As we can see FCF has grown at a pretty fast 11.7% which was caused by increasing CFFO, improving CFFO margin and decreasing CapEx margins. Their FCF increase in the last 6 years has been pretty slow but still consistent. They have a 6.2 P/FCF and a 16.12% FCF Yield which is absolutely insane.

Normally such a big dilution would be cause for concern, but in this case it was caused by their acquisition of Reynolds American which was funded through the exchange of newly created shares for Reynolds’ shares at 0.52/1 parity and $29.44 per share in cash for each Reynolds share. Since the acquisition was completed their share count has slightly decreased and they are now in the process of executing a 700M£ (1.1% of mkt. cap) buyback for 2024 and 900M£ (1.4% of mkt. cap) for 2025.

B.2. Return Metrics

Their ROE was 9% in 2022 (2023 was negative because of write-down) and the average ROE in the industry was 6% as of Q4 23 so they are above the industry average.

Their ROA was 4.3% in 2022 and the industry average was 2.4% as of Q3 2023.

RORC (Research on Return Capital) is a formula that is not that well know but it’s pretty useful since it shows how efficient a company’s R&D expenditure is and how much they are reliant on R&D. Since they have a ratio of 164 that means that they have a low reliance on R&D for the expansion of their business and that the relatively small R&D operation that they have is very good at generating returns through new products.

Their ROIC stood at 8.4% in Q4 24 compared to an industry average of 11.3%. Although they are below the industry average they are still at an acceptable ROIC that has improved continuously since 2017.

B.3. Ratios

B.3.a. Liquidity and Solvency

Their interest coverage ratio is 5.91, which is good because it shows that even during relatively high interest rate environments like today, they can still easily cover their debt payments. During the next few years their interest coverage ratio will increase because interest rates are slowly dropping worldwide so their interest payments will start decreasing. To add to this they have a lot of fixed-rate debt and a 9.2 year average maturity. (More on this a bit below)

Their Current Ratio is 0.88. A company with a current ratio of less than 1.00 does not have the capital on hand to meet its short-term obligations if they were all due at once so if they ever have a short-term emergency/liquidity crunch then they would have a pretty big problem on their hands.

LT Debt and Debt/Equity

They had a huge spike in debt when they acquired Reynolds American but since then they have decreased LT debt from 58B$ to 41B$ and now their Debt/Equity ratio stands at 0.6, which is in my opinion a moderate debt load, especially given that they have mostly fixed-rate debt so the debt that they are carrying is not a problem and they have the security of knowing that their interest payments will stay the same or slowly decrease because of the 16% of variable-rate debt that they have that is in correlation with the decreasing interest rates world-wide.

B.3.b. Inventory Analysis

1. DSO, DIO, DPO and CCC

A negative cash conversion cycle (CCC) occurs when a business collects payment from customers before paying suppliers. This means the company effectively uses supplier credit to fund operations, improving cash flow. Unlike income, which is recorded at the point of sale, CCC tracks cash exchange. A negative CCC can indicate efficient cash management but must be handled carefully to avoid straining supplier relationships or harming the brand. It often happens when goods are sold quickly, but supplier payments are delayed. Since BTI is an extremely large tobacco company they have huge power over their suppliers so it’s not a bad negative CCC where for example you have a small company that is actively delaying its payments to its suppliers.

Their Cash Conversion Ratio (CFFO/NI the one I used or sometimes CFFO/EBITDA or FCF/EBITDA - mostly in LBO scenarios) is excellent, the negative value for 2023 is caused by negative NI, but if we look in the past, especially since the acquisition of Reynolds American, they have had a CCR above 1 which suggests Excellent Liquidity and efficient working capital turnover, good receivables management, and favorable credit terms with suppliers. (Basically, a sign of a healthy negative CCC)

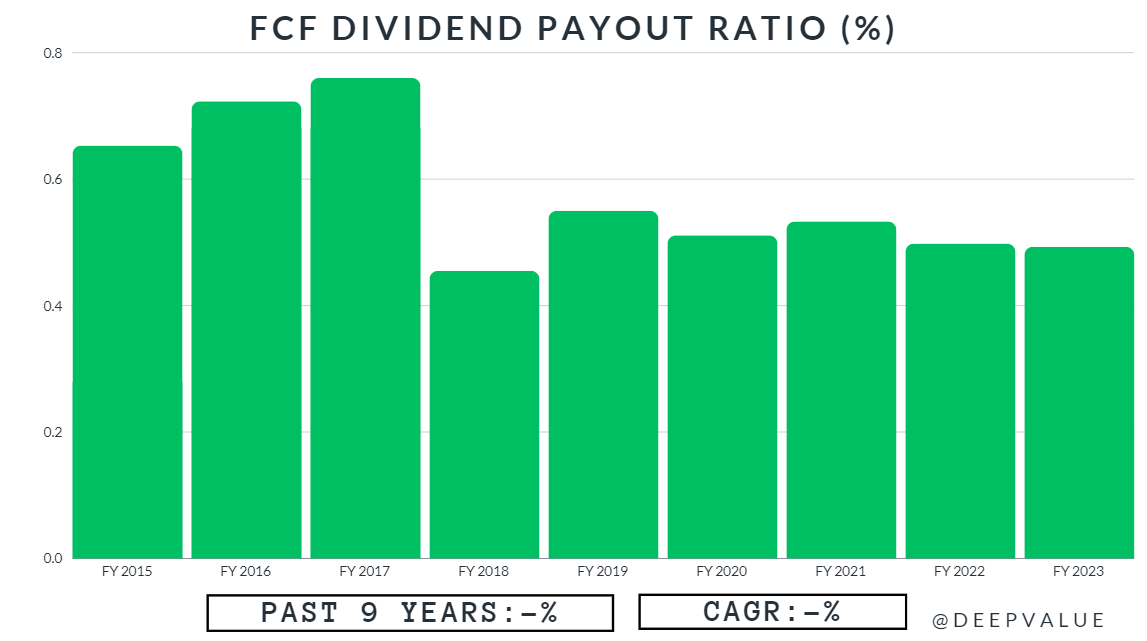

B.3.C. Safety of Dividend

Their FCF dividend payout ratio is 49.3% and it has stayed in the same range since the completion of the acquisition of Reynolds American. After looking at a lot a of metrics I have slowly realized that their acquisition was very well thought-out, as it looks like it helped their NI, OCF, FCF margins and growth, it improved their inventory (CCC and CCR especially), it improved their position in the market by consolidation and they are paying back the debt at an accelerated pace. Another big benefit of their acquisition is the lowering of their dividend payout ratio relative to FCF, basically giving them “more space to breath”.

C. Valuation

C.1. DCF

I will just lay out the assumptions (rev, cogs, etc. growth) and the NPV (net present value) but if you want to see the actual DCF then I attached the following image so you can look at it in detail.

The DCF was made with negative assumptions: the main revenue segment (all excl. NGP) starts declining from it’s current stagnation at a 2% pace and their NGP segment only manages to reach 30% of revenue share by 2033, behind management’s 50% expectation by 2035. Labor Government increases tax rate even further. CapEx and R&D start growing fast so they can reignite growth in NGP segment with new products. Complete stop of debt repayment and a debt increase that causes them to have slowly increasing interest payments. All margins drop very fast, except for gross margin which stays the same. Complete stop of buybacks.

I made a DCF using the following assumptions:

10 years of 1% growth rate

9% discount rate

-1% perpetuity growth rate

Constant 2232M Share Count - No Buybacks

COGS growth of 1%

SG&A growth of 1%

Net-non op. Interest (expense) growth of 1%

Tax rate of 27% - current Corporate Tax Rate in UK is 25%

Equity and Other Inc. stays relatively the same as the past 6 year average

R&D and CapEx growth of 6%

D&A growth of 2%

Change in WC growth of 2%

Other Non-cash same as 6 year average

Using the assumptions from above I arrived at a NPV/Share of 42.61£ , which at the current exchange (23.11.2024) is 53.39$.

C.2. NI/CFFO/FCF Multiples

I will be using the following multiples as I believe they are about right for the growth profile of the company: 10 P/E, 10 P/CFFO, 12.5 P/FCF.

10 P/E (2022) → 36.1$

10 P/CFFO (TTM) → 56.94$

12.5 P/FCF (TTM) → 71.06$

C.3. Analyst Price Target

1 Analyst rates it as a Buy. - There are only 4 analysts covering BTI

The High Target Price is 50$.

The Medium Target Price is 40.46$.

The Low Target Price is 33$.

I will be taking the lowest target price because my analysis is based on a hypothetical bear case.

C.4. Calculating Fair Value and Acceptable Buy Price

DCF Value: 53.39$

Average of Multiples: 54.7$

Low Analyst target price: 33$

Intrinsic/Fair Value = 47.03$

A.

Margin of Safety = 20%

Acceptable Buy Price = 37.6$

B.

Margin of Safety = 30%

Acceptable Buy Price = 32.92$

C.

Margin of Safety = 35%

Acceptable Buy Price = 30.57$

After using negative assumptions in the DCF, low multiples, the lowest analyst price target and a 20% Margin of Safety we have arrived at an acceptable buy price that is for now slightly above market value. I have also included a Buy price for 30% and 35% MOS and if it reaches that level then stock is a Great BUY. - That is not to say that you should buy it; as always Due Diligence is something everyone has to do, because maybe you find something I didn’t.

D. Moat

a. Global Reach and Market Position

BAT operates in over 180 countries, making it one of the most geographically diversified tobacco companies in the world. This extensive reach allows BAT to mitigate risks associated with regulatory changes and economic fluctuations in any single market. The company's global presence also provides economies of scale in production, distribution, and marketing, further strengthening its competitive position.

b. Strong Brand Portfolio

BAT's brand portfolio is one of its most significant competitive advantages. The company owns several of the world's leading cigarette brands, including Dunhill, Kent, Lucky Strike, Pall Mall, and Rothmans. These brands are well-established and enjoy strong customer loyalty, which is crucial in an industry where brand switching is relatively low. (I know a lot of smokers that have only smoked 1 or 2 types of cigarettes their whole life - maybe it’s just anecdotal evidence, but I think Tobacco may just be one of the best industries in terms of customer retention)

In addition to its traditional cigarette brands, BAT has made significant investments in next-generation products (NGPs) to cater to the evolving preferences of consumers. These include vapour products under the Vuse brand, heated tobacco products under the Glo brand, and modern oral products under the Velo brand. By diversifying its product offerings, BAT is well-positioned to capture market share in the growing NGP segment, which is expected to play a crucial role in the future of the tobacco industry, now that teens are basically dropping cigarettes for vapes and all of these new tobacco products.

c. Extremely consolidated industry and Pricing Power

As you can see there are 5 very big tobacco companies with approximately the same sales followed by ITC which has less than half the sales of the 5th company, Japan Tobacco.

82% of the Cigarette industry is controlled by the top 5 Companies. So BTI won’t have any new competitors any time soon. This also means that their margins won’t decrease since these 5 players have managed to keep margins very high and none of them has wanted to start a price war, and it wouldn’t even make sense. Why would you sell a cigarette packet for 1/2 the price when smokers will consume almost as much when the price could be higher.

E. Risks

E.1. Main Risk Short-Medium Term

One of the primary short to medium-term risks for British American Tobacco (BAT) is the shifting consumer preferences towards next-generation products (NGPs) like e-cigarettes and vaporizers. While these products are gaining popularity, they pose a significant risk due to lower brand loyalty compared to traditional cigarettes. Studies have shown that brand loyalty among cigarette smokers is relatively high, with many smokers sticking to their preferred brands for extended periods. In contrast, the e-cigarette market is more fragmented, with consumers frequently switching between brands and products based on factors such as flavor, price, and technological advancements.

This lack of brand loyalty in the vaping market can lead to increased competition and price wars, which may erode profit margins. Additionally, the regulatory landscape for e-cigarettes is still evolving, with many countries implementing stricter regulations on advertising, packaging, and sales. These regulations can create uncertainty and additional costs for BAT as they navigate the complex legal environment.

E.2. Main Long-Term Risk

The main long-term risk for BAT is the declining global demand for traditional tobacco products. The World Health Organization (WHO) has reported a steady decrease in smoking rates worldwide, driven by increased awareness of the health risks associated with smoking, higher taxes on tobacco products, and stringent anti-smoking regulations. This trend is expected to continue, posing a significant threat to BAT's core business.

Moreover, the long-term health effects of e-cigarettes and other NGPs are still not fully understood. While these products are marketed as safer alternatives to traditional cigarettes, there is growing evidence that they may still pose significant health risks. For example, e-cigarette aerosols contain harmful substances such as nicotine, heavy metals, and volatile organic compounds, which can have adverse effects on respiratory and cardiovascular health. As more research is conducted, there is a possibility that stricter regulations will be imposed on NGPs, further impacting BAT's business.

E.3. Other Risks

Regulatory Risks

The tobacco industry is one of the most heavily regulated industries globally. BAT faces significant regulatory risks as governments continue to implement stricter measures to reduce tobacco consumption. These regulations include higher excise taxes, plain packaging laws, advertising bans, and restrictions on smoking in public places. Compliance with these regulations can be costly and may impact BAT's ability to market and sell its products effectively.

Litigation Risks

BAT is also exposed to litigation risks, as the tobacco industry has a long history of legal battles related to the health impacts of smoking. Lawsuits can result in substantial financial penalties and damage to the company's reputation. Additionally, as the market for NGPs grows, BAT may face new legal challenges related to the safety and marketing of these products.

F. Conclusion

Their fundamentals look great, their debt is being reduced at an accelerated pace, they are doing stock buybacks, they are trading below fair value and their main risks are not company specific, but apply to all companies in their industry.

I would personally rate BTI as a BUY.

If you are looking for a bigger MOS then you should keep BTI on a “short leash” until it reaches a 30% or 35% MOS.

Disclaimer: This is not intended to be investment advice, and readers should not rely solely on the information provided in this article to make investment decisions. Any action taken by the reader based on the information in these videos is solely at their own risk.

Readers are encouraged to seek the advice of their own investment consultants or certified financial advisors before making any investment decisions. Any decision to invest in any securities or financial instruments should be made only after conducting thorough independent research.