CROX Stock Analysis

Today, we’re taking an in-depth look at Crocs, Inc. , ticker symbol CROX. We’ll dive into the financial metrics, assess the company’s growth, and ultimately try to find its fair buy price.

Current Stock Price (9th of Nov. 2024) - 101.3$ | Current Market Cap - 5.9B$

In the past year CROX has been underperforming the market mainly due to their HEYDUDE acquisition that has mostly been a drag on the company, being financed through 2.05 B$ in debt and 450 M$ in stock. BUT, is CROX a Value Play or just a dead Weight on investment accounts? Let’s see.

A. Story/History

Crocs, Inc. is an American footwear company based in Broomfield, Colorado, that manufactures and markets the Crocs brand of foam footwear. Crocs, Inc. term these "clogs".

Timeline:

2002–2007

Crocs was founded in 2002 by Scott Seamans, Lyndon "Duke" Hanson, and George Boedecker Jr, inspired by the design from Foam Creations, Inc. of Quebec. Their first model, the Beach, debuted at the Fort Lauderdale Boat Show, selling out 200 pairs. As demand grew, Crocs rebranded in 2005 with the "Ugly Can Be Beautiful" campaign, contributing to its successful IPO.

2008–2015

During the 2008 financial crisis, Crocs’ stock fell sharply, leading to layoffs and restructuring. In 2010, they further streamlined operations, reducing their workforce and closing underperforming stores. The company saw stock drops in 2011 and 2013 due to lowered earnings forecasts and decreased net profits. In 2013, Blackstone invested $200 million in Crocs, allowing for leadership changes and a stock buyback.

2016–Present

By 2017, Crocs had sold 300 million pairs. In 2018, they closed their last in-house manufacturing plants. Crocs responded to the COVID-19 pandemic in 2020 with the "Free Pair for Healthcare" program, donating shoes to frontline workers. The pandemic also fueled a sales surge from people seeking comfortable work-from-home footwear. Collaborations with designers and marketing boosted Crocs' image and growth through 2022.

Acquisitions

Crocs expanded through acquisitions, including Jibbitz in 2006, Ocean Minded in 2007, Bite Footwear in 2007, and Tidal Trade in 2008. In 2022, Crocs acquired Italian shoe company HEYDUDE for $2.5 billion, marking a major expansion. Since the onset of Russia’s invasion of Ukraine, Crocs has suspended operations in Russia and committed support to UNICEF.

B. Fundamentals/Metrics/Ratios

B.1. Fundamentals

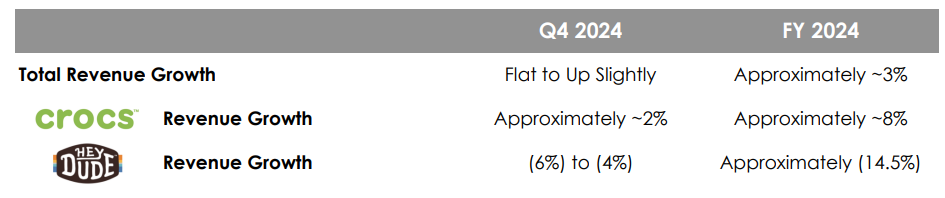

Over the past 8 years their revenue has grown at a 17.5% CAGR, most of which is because of their pandemic boom in popularity which has definitely slowed down because in the next few years their growth will be in the low single digits according to the companies own estimate. At the moment 80% of their revenue is from the Crocs brand and only 20% from HEYDUDE. 56% of their sales volume is in North America, the other 44% being international and 51% of their sales are Wholesale, while the other 49% DTC (Direct-To-Consumer).

As we can see from their investor presentation the HEYDUDE brand is a drag on the company as a whole and I personally believe that by 2026 its share of the revenue will drop to sub 13.5%, unless they turn the ship around.

Their Gross Margin has improved from 46.8% in Q4 2015 to 58.1% which is incredible since the industry average is 49%. This shows that they have a true money maker product and brand. What is even more interesting is that the HEYDUDE Brand decreased their Gross Margin and if it weren’t for that it would be closer to 62%.

They’ve managed to go from -80M$ to 790M$ in 8 years so that is definitely impressive, although as we can see their NI has kind of stagnated in 2021 to 2023 and in the next 2 years it will continue to do so. Their P/E is 7.7.

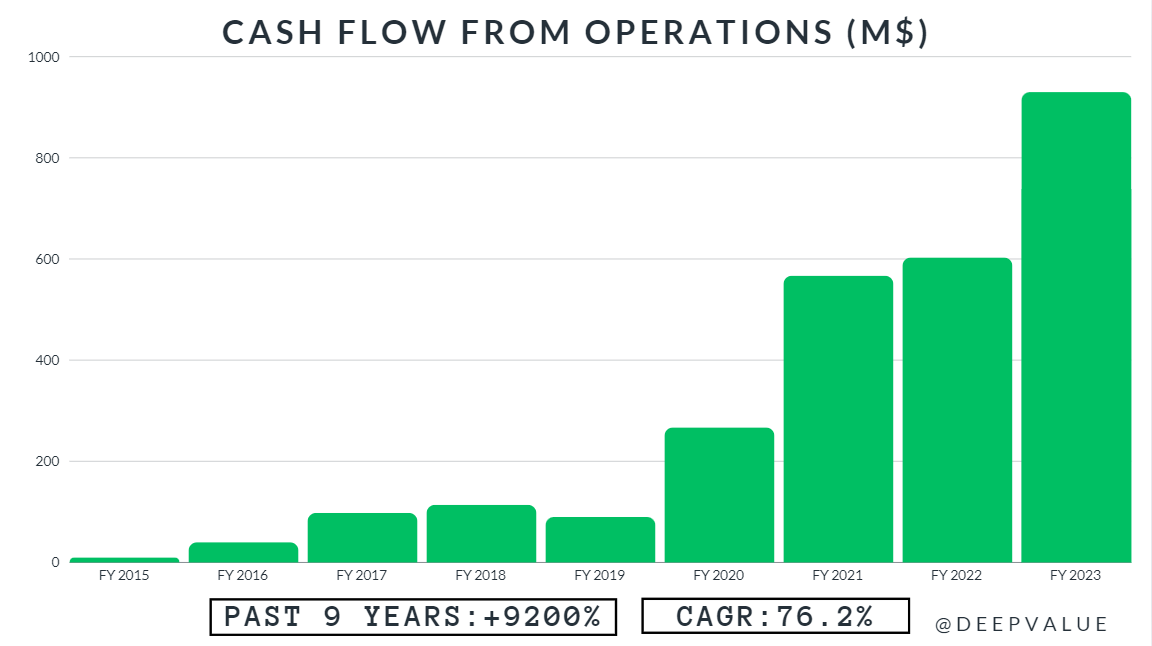

Their CFFO growth is definitely impressive and their TTM CFFO is 1.02B suggesting that their NI will rise in the future because CFFO and NI tend to converge. What is notable is that their P/CF is 6.06 which is extremely low.

Their CapEx has grown much less than CFFO, which is good because their CapEx margin (CapEx/Revenue) has become much smaller compared to CFFO margin, leaving a lot of space for FCF margin expansion. Their HEYDUDE acquisition doubled their CapEx and it will continue to maintain it an elevated level with a range of 90-100 M$ for FY2024.

Their CFFO margin in 2015 was 0.1% and now (Q3 24) it sits at 25.1%.

Their CapEx margin in 2015 was -2.2% and now it is -2.5%.

Their FCF has grown at an insane 75.5% CAGR and although its growth will slow down to mid-single digit levels, their P/FCF is 7.6 which is very low. I believe that because they will continue growing but at a slower pace they deserve a P/FCF of ~12.5.

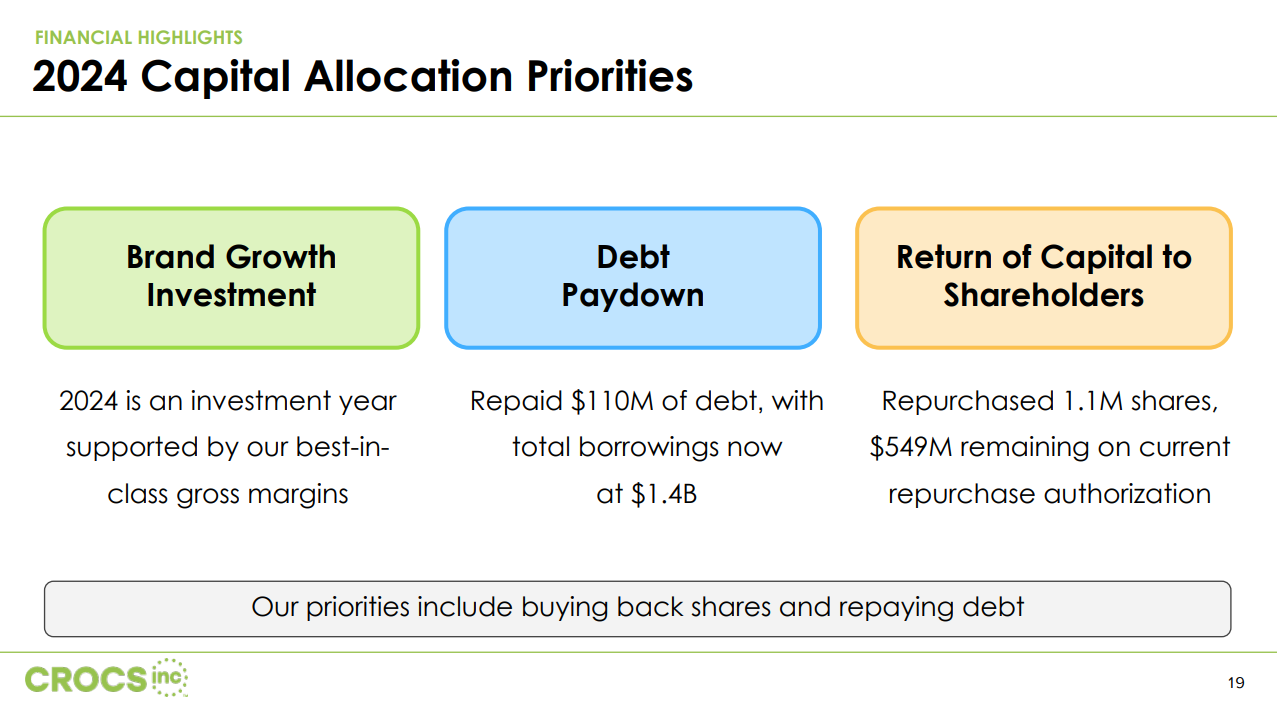

We can see that they have continuously provided value to shareholders through buybacks, buying back, on average 2.8% of their Outstanding Shares yearly. And this will continue into the future through their current repurchase authorization which has 549M$ left (8.9% of current market cap).

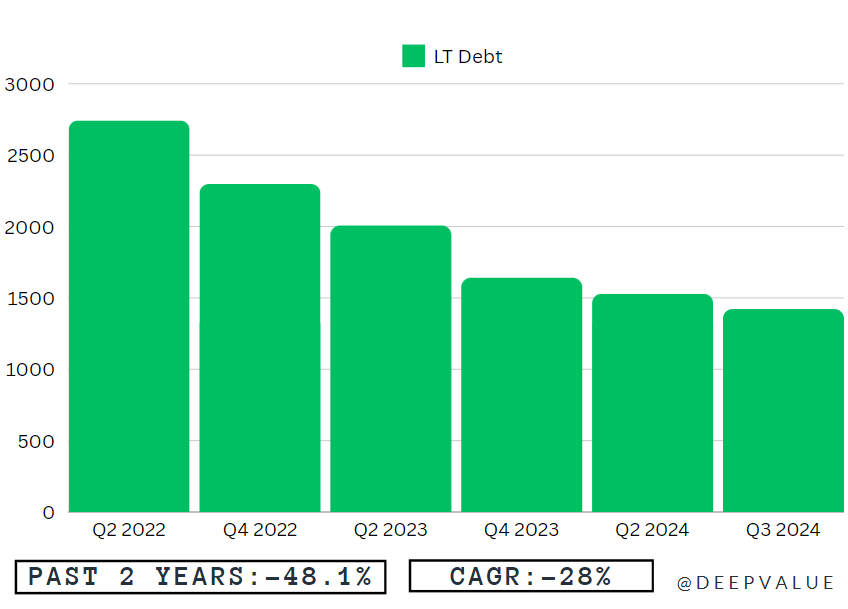

What I like about their Capital Allocation Priorities is not only their focus on buybacks but also on their debt paydown. Their Brand Growth Investment mostly refers to HEYDUDE because they need to somehow turn it around but their entire CapEx is 100M$ so most of their actual Capital allocation is going to buybacks and debt reduction.

B.2. Return Metrics

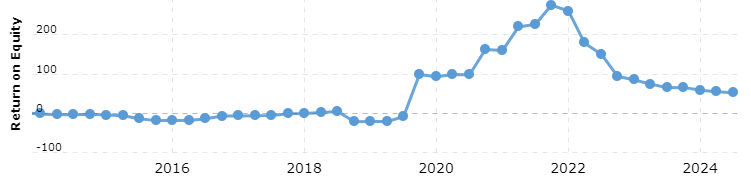

Their ROE (as of Q3 24) is a healthy 48.3% and as we can see it has been pretty stable in the last 1.5 years. The decline from the peak is to be expected as their Equity increases over time and NI becomes smaller relative to it. Average ROE in their industry is 30.5%.

The ROA is 17.7% and has improved by 580 basis points from 11.9% in the past 1.5 Years. Nike’s ROA is 14.1%, Ralph Lauren is 10.1%, Guess 6.5%, LVMH 9.7%. I gave some examples from different parts of the fashion/clothing/Shoewear industry so that you can paint a clearer picture in your head. Average ROA in their industry is 11.5%.

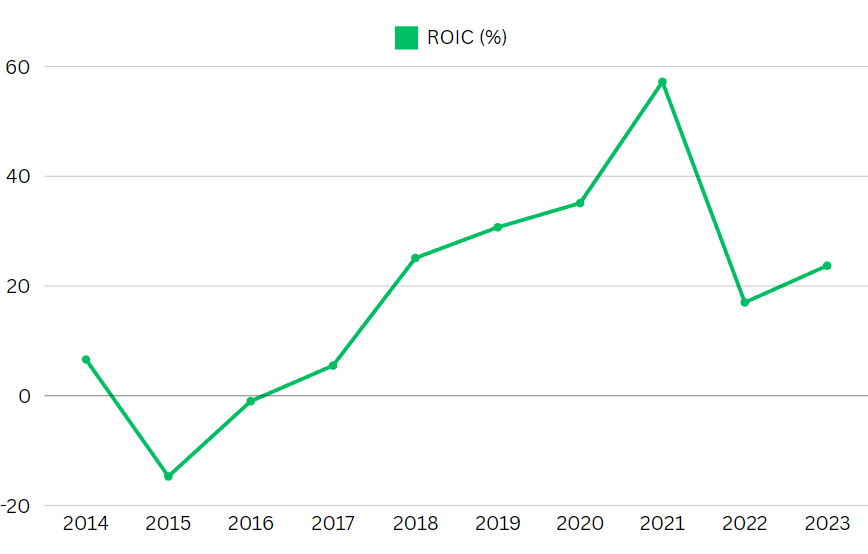

Their ROIC is an impressive 23.7% (as of Q4 23). Average ROIC in their industry is 24%.

B.3. Ratios

We’ll cover Liquidity and Solvency.

Their Interest coverage ratio is 8.7, which is good because it shows that even during relatively high interest rate enviorments like today, they can still easily cover their debt payments. During the next few years where the interest rates will drop and they will continue to repay the debt used for the HEYDUDE acquisition the interest coverage ratio will definitely grow to >15.

Their current Ratio is 1.43. This shows that they have a good ability to handle short term liquidity crunch, as their current assets easily cover their current liabilities.

LT Debt/Equity and Debt/Equity

Their Debt has basically almost only consisted of LT debt and as we can see they had been mostly debt free until their HEYDUDE acqusition which propelled their debt, but they have managed to reduce their D/E ratio from 8.17 (Q1 2022, excl. that anomaly in Q4 2021) to 0.82 (Q3 24) which is seriously impressive because this shows that management is capable of repairing their mistake and helping the balance sheet recover.

C. Valuation

C.1. DCF

I will value them using a DCF, NI/CFFO/FCF multiplier and analyst expectations.

I will just lay out the assumptions (rev, cogs, etc. growth) and the NPV (net present value) but if you want to see the actual DCF then I attached the following image so you can look at it in detail.

The DCF was made with negative assumptions, factoring in a hypothetical scenario where gross margins drop, SG&A increases faster than revenue, capex grows with no subsequent noticeable results, etc. So these assumptions are based on a continued failure to prop up the HEYDUDE brand and a continuous increase in spending to maintain their Crocs brands at mid single digit growth rate (something which is not happening at the moment because their CapEx has remained <2.5% of revenue for their entire history) and the stop of their buyback and debt reduction program (in fact I assumed a increasing debt burden causing increasing interest expenses).

I made a DCF using the following assumptions:

10 Years of 4% revenue growth

9% Discount Rate

-1% perpetuity growth rate

Constant 58.3M share count - No Buybacks

COGS growth of 4.5%

SG&A growth of 4.5%

Interest Ex. growth of 2% and Interest Inc. of 1%

Tax Rate = 19%

D&A (Depreciation & Amortization) and Operating Lease Cost growth of 2%

SBC (Share-Based Compensation) growth of 6% (Executives always pay themselves more than they deserve)

Deferred Tax decline of 1% yearly (It’s already way above historic averages and double the average industry + their last 3 quarters have a total of 80M$ in deferred taxes and Q4 23 is an anomaly that skyrocketed their 2023 Def. Tax.)

Change in WC (Working Capital) - starting with the average of 2021,2022,2023 with a following growth rate of 5%

Using the assumptions from above I arrived at a NPV/Share of 109.63$.

C.2. NI/CFFO/FCF multiples

I will be using the following multiples as I believe they are about right for the growth profile of the company: 10 P/E, 10 P/CFFO, 12.5 P/FCF.

10 P/E → 143.2$

10 P/CFFO → 175$

12.5 P/FCF → 201.6$

C.3. Analyst Price Target

12 Analysts rate it as a Buy.

The High Target Price is 180$.

The Medium Target Price is 142.45$.

The Low Target Price is 110$.

I will be taking the lowest target price because my analysis is based on a hypothetical bear case.

C.4. Calculating Fair Value and Acceptable Buy Price

DCF Value: 109.63$

Average of Multiples: 173.27$

Low Analyst target price: 110$

Intrinsic/Fair Value = 130.97$

Margin of Safety = 20%

Acceptable Buy Price = 104.78$

After using very negative assumptions in the DCF, low multiples, the lowest analyst price target and a 20% Margin of Safety we have arrived at an acceptable buy price that is for now slightly above market value. The fact that I have included a 20% MOS means that the current stock price makes the stock a Great BUY. - That is not to say that you should buy it; as always Due Diligence is something everyone has to do, because maybe you find something I didn’t.

D. Risks

The main short/medium-term risk is tariffs being imposed by Trump, now that he will be taking the oval office in 2025. Other than China which is going to be heavily tariffed, most other countries will be moved to a 20% tariff which will eat into crocs margin considerably but everyone will increase prices so how much they are affected by this is mostly a sign of the industry itself. If demand remains unchanged then all will happen is an increase in revenue and drop in gross margins.

Crocs are manufactured in the following countries:

Vietnam: 53%

China: ~20-30%

Indonesia: ~10%

Luckily, Crocs outsourced all of their production in 2018 and now they can easily transfer production from china to Vietnam and Indonesia, maybe even getting more favorable rates for increased production.

There is one main advantage for them because a lot of their production happens in Vietnam and that is that both Trump himself and the US Government have big economic interests there.

A. The Trump Organization has recently partnered with a Vietnamese company to develop a $1.5 billion golf course and hotel project in Vietnam, a Vietnam-based foreign investor said.

B. Imports of liquified natural gas (LNG) and the possible purchase of Lockheed Martin C-130 Hercules military transport.

However, in 2019 Trump became increasingly frustrated at countries that enjoyed large trade surpluses with the US. That year, Trump called Vietnam the world's "worst abuser" of US trade, worse than China, as the country's trade surplus with America stood at around $54 billion that year. In its final months, the first Trump administration started formal proceedings to sanction Vietnam for alleged currency manipulation, although the Biden administration abandoned this. Hanoi has waited nervously for the US elections, knowing that its trade surplus with the US spiked to €96 billion last year.

We will have to wait and see but if the tariffs happen, it’s hard to predict what will follow and as always you have to try and form your own opinion on this subject.

The other risk for Crocs is that the brand will start declining but this is a purely speculative risk that is based on random assumptions so I will not try to make myself look like I have the precise chance for this risk to become a reality and if so how bad the decline would be. After all, this risk applies to all companies that have created a brand (e.g. Nike, Puma, Adidas, LV, Dior, etc.).

E. Conclusion

Their fundamentals look great, their debt is being reduced at an accelerated pace, they are doing stock buybacks, they are trading below fair value and their main risk is not company-specific.

I would personally rate CROX as a BUY.

Disclaimer: This is not intended to be investment advice, and readers should not rely solely on the information provided in this article to make investment decisions. Any action taken by the reader based on the information in these videos is solely at their own risk.

Readers are encouraged to seek the advice of their own investment consultants or certified financial advisors before making any investment decisions. Any decision to invest in any securities or financial instruments should be made only after conducting thorough independent research.