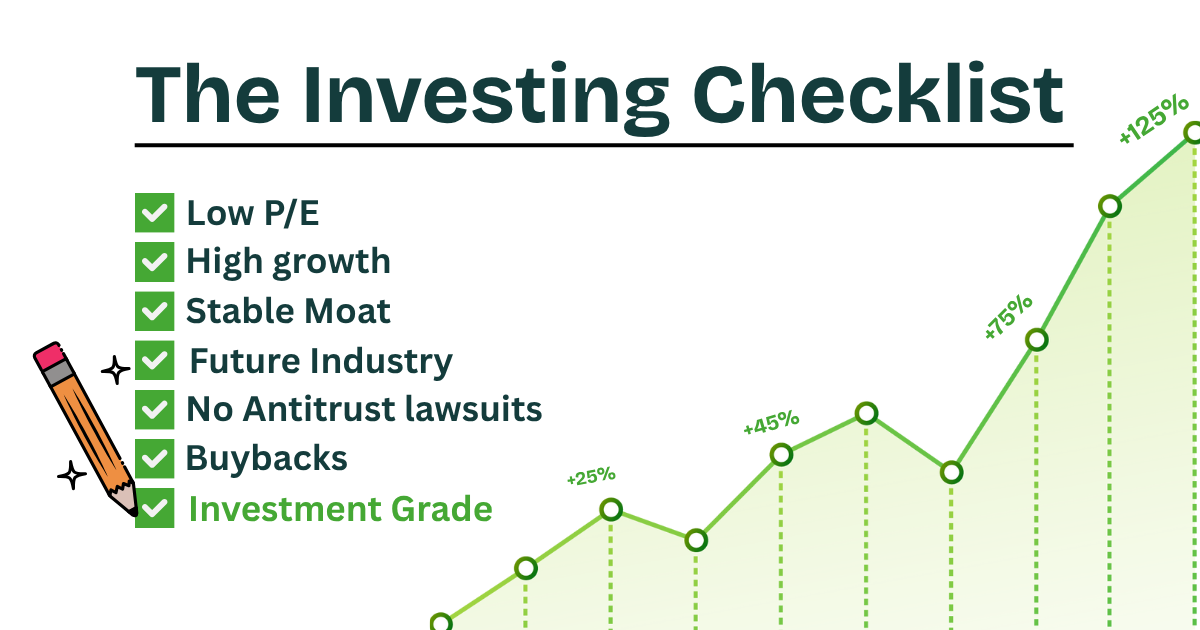

The Investing Checklist

A very simple yet often overlooked approach to value investing. Today I will show you how I use it and, how you can apply it too when prospecting for high-quality investments.

In this article I will talk about the Investing checklist and I will give an in-depth example to show the strategy’s practicality.

There are many ways to analyze a company but the most important thing about any analysis is to standardize the procedure. There will be many companies that are worth investing in, but lacking a clear procedure to analyze a new company will quickly lead to you wondering if one is investment-grade or not.

The investing checklist is great precisely because it simplifies the investing process only into a few steps:

1. Find a stock to analyze

2. Slowly go through the checklist marking or not marking the fulfilled/unfulfilled criterion

3. Stop if the checklist has too many unfulfilled criteria OR end up with a stock that passes the minimum point requirement

4. Start proper DD and read 10-Ks and 10-Qs like they are necessary for survival. Crosscheck management promises and actual performance, look for anomalies, look for hidden dangers or opportunities, etc.

A. Points system

The points system is very straightforward. You first create a checklist and, after that, you assign points for each criterion. At the end you tally up the points and if the number of points reaches the desired minimum, the respective company you are prospecting becomes a potential investment. Of course, after that it is necessary to do more in-depth analysis, but as a general rule, if you include enough measurements and are careful, you will already have a pretty clear picture after using the points system.

A.1. Investing Threshold

I would suggest at least 85% of your total points should be the investing threshold that you can set. So for 100 points (5 points per criterion) you would need 85 points.

A.2. ‘Golden’ checks

To prevent value traps or one-sided financials (Great Balance sheet, cash furnace; Great Cash Flow statement, bad growth prospects; etc.) you need Golden Checks. If a company has enough points, but doesn’t have the golden checks, then it is automatically disqualified from becoming an investing prospect.

As an example, you can set a Debt/Equity of max 0.9, or a 1% max CAGR in common shares, etc. These are to be hard lines that cannot be crossed, and unless management isn’t aggressively speeding towards meeting these criteria, you can skip the company.

B. What to measure

Knowing what to measure is extremely important. And the most important thing I recommend is knowing how to distinguish between plays. In Value Investing there are 2 general plays:

1. Cigar Butt/Deep Value Play

2. Buffett Play

For Deep Value there are multiple scenarios (Extremely cheap P/B, bankruptcy cases, very high Dividend yield, etc.), but excluding those I recommend having at least 2 checklists in total. The Checklist for the Cigar butt will not have the same valuations or management measurements as the Buffet play for example.

The Cigar Butt/Deep Value Play is mostly when you find an extremely undervalued company at a good MOS (>30%) and that has little to no future growth prospects. These are meant to be sold at fair value, or slightly above, usually giving a quick 50-70% profit. (In most cases they also give a big dividend so the total return is closer to 75%).

The Buffett Play can be done at or below fair value, but it has to be a very high quality company with an impenetrable moat and good future growth prospects. These can be held “forever”. They are to be sold only when there is an extreme bubble (trading >2.5 times fair value), when the moat is in danger, or when there is a serious personal need for money.

Practical Example:

Cigar Butt - BTI (bought in at 29.3$ in May last year, and made +35% incl. Dividends, during the same time the S&P grew 3% incl. Dividends) - numbers given to exemplify a normal return for a cigar butt play.

A lot of REITS fall under Cigar Butt. My most recent REIT play was HIW (+80% in 1 year - basically the maximum realistic gain on a quick Cigar Butt in the current market), unless you go for the penny stocks.

Buffett Play - AAPL, NFLX (2022-2025), MSFT (Post-2000 - Now), AMZN (Post-2000 - Now), AXP (1991-Now), etc.

Now, that we’ve covered the 2 main types of checklists, let’s see what to measure.

B.1. Company Measurements

Company measurements are measurements that can be made based on 10-K or 10-Q financial data, or company news.

So:

Balance Sheet (Easy)

Income statement (Easy)

Cash flow statement (Easy)

10-K other - Management, Legal, Anomalies in Reporting, etc. (Hard)

For some of these measurements I have used my personal numbers, but I recommend you set out to make your own ones. Just because some metrics and their respective targets work for me, doesn’t mean you should just copy them. For more subjective value metrics, I have kept personal input to a minimum, due to the wide variety of valuation plays that I’ve made which don’t conform to a rigid valuation standard. For example 10 P/FCF may work on some companies, but you’ll miss the 15 P/FCF opportunities. You have to choose for yourself.

B.1.a. Easy Measurements

Bold is for crucial measurements.

Balance Sheet

Efficiency Ratios:

a. Inventory Turnover Ratio

b. Receivable Turnover Ratio

c. Payables Turnover Ratio

d. Asset Turnover Ratio

Solvency Ratios:a. Debt to equity ratio (Industry dependent)

Liquidity Ratios:a. Current Ratio >1

b. Quick Ratio >1.5Profitability Ratios (vary depending on industry, to be selected case by case - also, they are also part of Income statement measurements):

a. ROA > 10%

b. ROE > 20%

c. ROIC > 10%

Personal additions:a. Cash & Cash equivalents > Debt (short term + long term)

b. Low Preferred Stock

c. Accounts receivables growth % <= Revenue %

d. Goodwill < 50% of Assets

e. Retained Earnings growth

f. Treasury Stock <0

g. P/B (Depends on industry)

h. Number of Common Shares outstanding 5 years max +1% (Not applicable to REITs)

i. IF dividend payer, then at least 20% growth in Dividend past 5 years (Not CAGR) - Dividends are part of balance sheets since they take from retained earnings and reduce shareholders’ equity.Income statement

a. P/Eb. Stable Gross Margin

c. Past 5 year growth (not CAGR):

- [ ] Rev. growth past 5 years: >20%- [ ] Earnings Growth past 5 years: >22.5%

- [ ] Rev. growth next 5 years: > 20%

- [ ] Earnings growth next 5 years: >22.5%

d. Interest Coverage Ratio

e. Buffett Return > 25% (For premium subscribers)Cash flow statement

a. P/OCF

b. P/FCF

c. 20% MOS on a conservative 9% Discount rate, -1% perpetuity growth rate DCF

d. Cash From Operations past 5 years: >22.5%

e. Cash conversion cycle

f. Days sales outstanding

g. Days payable outstanding

h. Cash flow coverage ratio

i. Dividend Coverage Ratio (with OCF, not NI)j. Stable Operating Cash flow margin

Keep reading with a 7-day free trial

Subscribe to Deep Value Investing to keep reading this post and get 7 days of free access to the full post archives.